Global Dairy Trade Index Rises 6.3% at First 2026 Auction

Following a poor run of results in recent months, the Global Dairy Trade (GDT) has recorded a positive start to 2026.

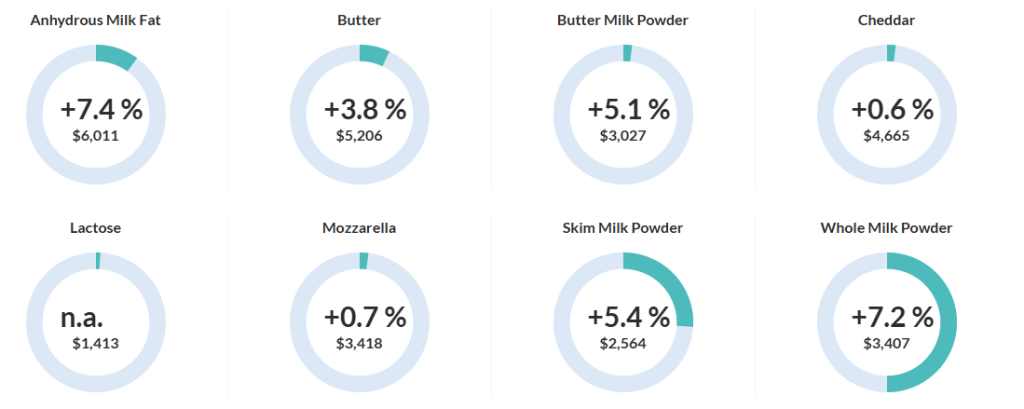

The inaugural Global Dairy Trade (GDT) event of 2026, identified as Event 395, took place on January 6 and sent a positive message to the international dairy market. The GDT Price Index experienced a notable rise of 6.3% compared to the previous event, signifying a robust start to the year for global dairy prices.

Experts noted that the strong rise in the index (+6.3%) was largely driven by the significant share of milk powder—especially whole milk powder—in total traded volumes, which were considerably lower than at previous auctions.

The auction highlighted a strong buyer presence, with average winning prices hitting USD 3,533 per metric ton, indicating increased competition and willingness to pay among buyers. There were 177 registered bidders participating in the auction, out of which 114 emerged as successful buyers.

The auction was extensive, comprising 26 bidding rounds over a span of 2 hours and 57 minutes, underscoring the intensity and demand present in the market. The volume of dairy products traded ranged between 27,936 and 34,923 metric tons, with the total quantity sold amounting to 29,282 metric tons, consistent with recent events.

This strong performance in the first GDT of 2026 provides a positive outlook for dairy producers, processors, and exporting countries, who are closely monitoring international price trends following a cautious end to 2025.